Trending stocks today

TSE:ZWU

10.06Related posts

ETF Must-Read: Top 25 ETF-Related Questions AnsweredOur Mega List of the Latest ETFs Mentioned on StockchaseETFs for everyone: Most Popular ETFs for Your PortfolioThis summary was created by AI, based on 19 opinions in the last 12 months.

The reviews from different experts on BMO Covered Call Utilities ETF (ZWU-T) convey that the ETF provides a good dividend yield, but it may underperform in terms of growth. It is considered a defensive stock with a reliable dividend, but may not offer significant capital appreciation. The covered call strategy is seen as a way to enhance yield, but it also limits potential upside. Overall, it is viewed as a good option for income-seeking investors who are not looking for substantial growth.

ZWU's covered call will pay a higher dividend, though FTS' is solid and growing. ZWU pays more income because you're selling calls. The downside is that as interest rates decline, utilities will improve and you will lose that upside if you hold ZWU and not a plain ETF or Fortis itself. If you are positive utilities, don't use a covered call ETF.

Covered calls supplement income, but sometimes the underlying security performs better over time. Not in this case, which is rare (ZWU vs ZUT). ZWU pays an 8.5% dividend, including the covered call overlay. Share price has risen since October. Utilities are not a growth area, but bought for cash flow and income. Do you want the yield or growth?

Great dividend, but not a lot of growth in terms of earnings. So total return not spectacular. Utilities don't grow at 15% earnings growth rates the way, say, a MA would.

With covered call strategies, you're missing some of the upside over time. You have to really understand what you need this for, income is a prime reason. MERs are also usually higher.

Defensive stock with excellent yield (~7-8%). Would recommend buying on stock price lows. Not a growth company, so don't expect major capital appreciation. On flip side, would recommend trimming on peaks.

Higher volatility option for a low volatility underlying asset(utilities). Nice enhancement option, but would recommend small position.

Good option for investors worried about recession. Defensive name with reliable dividends. Won't be hit as hard. Also, falling interest rates good these companies.

Nice income on this strategy. Yields about 8.25%. Interest rates are starting to steady and potentially pivot lower. As rates start to move lower, some of these dividend stocks, like pipelines or telecoms or banks, will look very attractive as they start to recover.

If you don't need the income, he prefers the underlying securities. Covered calls mean you lose out on some upside. Plus, these ETFs tend to charge higher expense ratios.

Dividend stocks should start to recover a bit once the 10 year bond yields start to back down. This ETF has a return of 5.6% so you can hold for when rates start to come down.

Also part of the question was on covered call strategies. Unless the underlying security is flat or falling you may see some under-performance related to the security itself

Likes stock at $10 or $11 (better value). Good for yield seeking investors. Underlying assets very safe. Good time to buy.

8%+ dividend yield due to covered calls. When rates start turning down, these names will benefit and move higher. 71 bps, more expensive than average. Great for income, nice payment as you wait for the turnaround.

With the ROC component, the after-tax yield compares very well to alternatives, but it is hard to say whether it fully compensates, as investors have different tax brackets. If we look shorter term, its five year return is better, at 3.1%. But over ten years, it is down 26%, but with distributions 10-year net is 4.08%. Considering the very weak performance of the last year as interest rates spiked, we would still consider this 'OK' all things considered.

Unlock Premium - Try 5i Free

Owns full position in this stock.

Good time to buy given current price.

Lots of value with industry fundamentals.

Generally, utilities are a safe investment.

Rising rate environment will negatively impact utilities.

If rates are cut, utilities will perform better.

Income is fairly safe within utility sector.

BMO Covered Call Utilities ETF(ZWU-T) Frequently Asked Questions

What is BMO Covered Call Utilities ETF stock symbol?

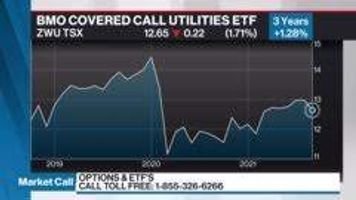

BMO Covered Call Utilities ETF is a Canadian stock, trading under the symbol ZWU-T on the Toronto Stock Exchange (ZWU-CT). It is usually referred to as TSX:ZWU or ZWU-T

Is BMO Covered Call Utilities ETF a buy or a sell?

In the last year, 18 stock analysts published opinions about ZWU-T. 9 analysts recommended to BUY the stock. 2 analysts recommended to SELL the stock. The latest stock analyst recommendation is . Read the latest stock experts' ratings for BMO Covered Call Utilities ETF.

Is BMO Covered Call Utilities ETF a good investment or a top pick?

BMO Covered Call Utilities ETF was recommended as a Top Pick by on . Read the latest stock experts ratings for BMO Covered Call Utilities ETF.

Why is BMO Covered Call Utilities ETF stock dropping?

Earnings reports or recent company news can cause the stock price to drop. Read stock experts’ recommendations for help on deciding if you should buy, sell or hold the stock.

Is BMO Covered Call Utilities ETF worth watching?

18 stock analysts on Stockchase covered BMO Covered Call Utilities ETF In the last year. It is a trending stock that is worth watching.

What is BMO Covered Call Utilities ETF stock price?

On 2024-04-24, BMO Covered Call Utilities ETF (ZWU-T) stock closed at a price of $10.06.

Excellent product with ~8% dividend yield. Concern about BCE dividend sustainability. Good time to buy. Would recommend holding for the long term.